- 5 Best Boston Neighborhoods for Real Estate Investment 2025

- Buying Rental Property in Boston | Top 3 Cities to Invest In

- 1. South End

- 2. Dorchester

- 3. Jamaica Plain

- 4. Beacon Hill

- Strong Rental Market

- Walkability and Transit Access

- Historic Charm and Stability

- sbb-itb-f750c3f

- 5. Seaport District

- Infrastructure and Development Drivers

- Life Sciences and Innovation Hub

- Rental Market Potential

- Neighborhood Comparison: Pros and Cons

- Conclusion

- FAQs

- What should investors consider when deciding between Dorchester and Beacon Hill for real estate investment?

- How are infrastructure upgrades in Boston's Seaport District influencing its real estate investment potential?

- Boston's Seaport District: A Growing Hub for Investment

- What are the advantages and risks of investing in Jamaica Plain compared to other top Boston neighborhoods in 2025?

- Investing in Jamaica Plain: Pros and Cons

Real Estate

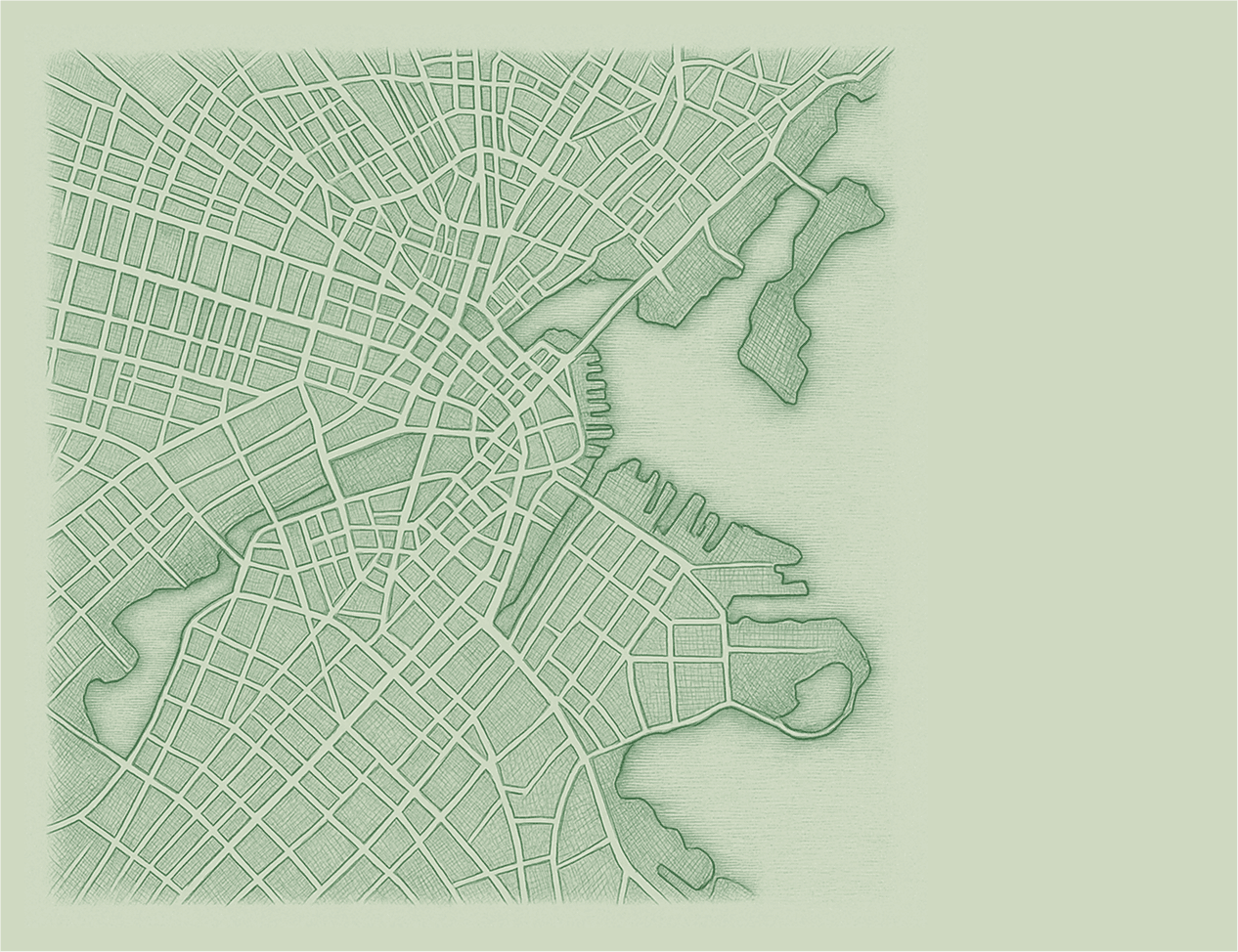

5 Best Boston Neighborhoods for Real Estate Investment 2025

Boston's real estate market in 2025 offers opportunities for both steady rental income and long-term appreciation. Key factors like low vacancy rates (2.8%), strong rental demand, and a median home price of $870,000 make it an attractive location for investors. Choosing the right neighborhood is critical, as each offers unique benefits and challenges.

Top Neighborhoods for Investment:

- South End: High-end area with historic charm, low vacancy (2.8%), and premium rents averaging $4,190/month.

- Dorchester: Affordable with strong cap rates (6–7%) and redevelopment potential.

- Jamaica Plain: Vibrant community with median prices around $815,000 and stable rental returns (5.5–6.5% cap rates).

- Beacon Hill: Prestigious area with historic appeal, strong rental demand, and a median price of $1.8M.

- Seaport District: Modern, luxury-focused area benefiting from infrastructure upgrades and innovation hubs.

Quick Comparison:

| Neighborhood | Median Price | Cap Rates | Key Features |

|---|---|---|---|

| South End | $1.3M | 3-4% | Historic charm, premium rents |

| Dorchester | $735K | 6–7% | Affordable, redevelopment potential |

| Jamaica Plain | $815K | 5.5–6.5% | Artsy vibe, stable returns |

| Beacon Hill | $1.8M | 3-4% | Historic, prestigious location |

| Seaport District | $1.9M | 3-4% | Modern amenities, luxury appeal |

Each neighborhood caters to different investment strategies, whether you're focused on cash flow, appreciation, or a balance of both.

Buying Rental Property in Boston | Top 3 Cities to Invest In

1. South End

The South End stands out as one of Boston's prime investment hotspots, blending historic charm with modern conveniences. This neighborhood is a magnet for high-income professionals and families who value urban living paired with unique architectural character.

As of May 2025, the median sale price in the South End hit $1.3 million, with a median listing price of about $1.2 million. Homes in this area typically spent just 22 days on the market. Prices showed a slight dip, with home values decreasing by 2.9% compared to the previous year, and properties selling for around 1.9% below their asking prices [3][4]. The median sale price per square foot was $1,130, reflecting a 4.4% drop year-over-year [3].

Rental properties in the South End also deliver impressive returns. The average monthly rent is $4,190 - over $1,200 above the metro average - with a notably low vacancy rate of 2.8%, compared to the metro area's 5.6%. Projections suggest rents may climb an additional 3–4% in the coming year [6].

The neighborhood's proximity to Back Bay and the Financial District adds to its allure, continually attracting professionals working in Boston’s central business hubs [1]. This location advantage, coupled with the area's iconic brownstones and tree-lined streets, supports strong rental demand and premium pricing.

Investment opportunities in the South End are diverse. Renovated properties and new developments command higher prices, while older units offer potential for value-add projects [1]. The area is also known for its boutique condos and mixed-use developments. As of the second quarter of 2025, condominium prices averaged $802,500, with a median price per square foot of $976 [5].

Market analysts suggest a "hold and optimize" approach for South End properties in the next 12 to 18 months. Strategic improvements can enhance returns, and with no new multifamily developments currently under construction, supply constraints are expected to keep both sale prices and rental rates strong [6].

In short, the South End offers a compelling mix of limited supply, steady rental demand, and a prime location, making it an attractive option for investors seeking reliable, high-yield opportunities in Boston. Up next, we'll take a closer look at Dorchester to see how it compares.

2. Dorchester

Dorchester stands out with its appealing cash flow and higher cap rates compared to Boston's more upscale neighborhoods. This vibrant and diverse area has become one of the city's busiest redevelopment hubs, making it an attractive option for long-term investors looking for growth opportunities.

As of May 2025, Dorchester's median sale price hit $725,000, reflecting a 2.0% drop from the previous year. However, the median sale price per square foot rose by 9.7% to $497, showing strong demand despite the slight overall price decline [7]. Homes in the area sell quickly, averaging just 21 days on the market, often sparking bidding wars [7].

Investors in Dorchester enjoy strong rental returns. Multi-family properties, typically priced between $900,000 and $1.5 million, deliver cap rates ranging from 6% to 7%, well above the 4–5% seen in Boston's premium neighborhoods [8]. For instance, a $1.1 million three-family property generating $108,000 in annual rental income - with $35,000 in operating expenses - produces a net operating income of $73,000, resulting in a 6.6% cap rate [8].

The rental market remains robust across various property types. Monthly rents average $1,800 to $2,200 for one-bedroom units, $2,400 to $3,000 for two-bedroom apartments, and $3,000 to $3,800 for three-bedroom units [8]. This demand comes from a diverse tenant base, including young professionals, families, and graduate students.

Dorchester's sub-neighborhoods offer distinct investment opportunities. Savin Hill and Jones Hill, for example, command higher property prices - ranging from $1.2 to $1.5 million for multi-family homes - with cap rates between 5.5% and 6.5%. On the other hand, Fields Corner provides some of the best returns, with properties priced between $850,000 and $1.2 million and cap rates reaching 6.5% to 7.5% [8]. Areas like Uphams Corner and Ashmont offer a balanced mix of risk and return [8].

The neighborhood's growth potential continues to rise. In Dorchester Center, the median sold price climbed to $760,000 in June 2025, marking an 11.8% year-over-year increase, with homes selling in an average of just 20 days [9]. Ongoing retail developments, better transit connections, and community investments are fueling demand, particularly near transit hubs and waterfront areas, which are expected to see the highest appreciation [1][2].

When compared to a property in Brookline priced at $2.2 million with a 4.5% cap rate, Dorchester's affordability and cap rates of 6–7% make it an appealing option for investors seeking strong cash flow [8]. This combination of affordability and returns sets Dorchester apart from other Boston neighborhoods, offering a compelling case for further exploration.

3. Jamaica Plain

Jamaica Plain continues to draw investors with its steady demand and growth potential. This lively neighborhood appeals to long-term tenants who are willing to pay premium rents, thanks to its unique community amenities and vibrant atmosphere [16].

As of June 2025, the median home sales price in Jamaica Plain reached $815,000, reflecting a 5.9% increase. Listings averaged $849,900, up 3.7%, and properties typically sold within 22 days, a 6.1% improvement in speed [10][11]. This quick turnover highlights the area's strong market activity and potential for solid rental returns.

The median price per square foot is $654 for listings and $660 for sales, marking a 2.8% year-over-year decrease. This slight dip suggests buyers are finding better value in the area [10][14].

Rental income opportunities in Jamaica Plain are particularly appealing. With 429 rental properties available, monthly rents range from $915 to $7,500, with an average rent of $2,049 [12][15]. One-bedroom apartments, in particular, command approximately $2,450 per month in 2025 [17]. Multi-family properties deliver cap rates between 5.5% and 6.5%, offering stable returns for investors [16].

For those seeking value-add investments, there are plenty of opportunities. Properties with below-market rents, cosmetic improvement needs, or located in transitioning areas can yield significant returns. Renovating units in multi-family buildings, for instance, can boost cap rates, especially given the area's appeal to high-quality tenants [16].

Jamaica Plain's appeal goes beyond property metrics. The neighborhood retains its artistic and progressive vibe, supported by improved public transportation options like the Orange Line and new shuttle services. Its community-oriented atmosphere attracts a diverse mix of creatives, young professionals, and families, ensuring stable rental demand [17].

"People love JP, with its beautiful quality of life", says Constance Cervone of constance.cervone@cbrealty.com [13].

The area's green spaces, including Jamaica Pond and its proximity to the Arnold Arboretum, enhance its desirability for both tenants and buyers. Locally owned businesses along Centre Street add to the neighborhood’s charm while supporting property values. Additionally, property crime rates have dropped by 9.3% year-over-year, boosting the area's safety and overall appeal [17].

Jamaica Plain’s economic profile also adds to its investment potential. The average household income in the 02130 zip code stands at $137,908, while average property prices hover around $816,949 [18]. This balance of affordability and upward mobility makes it attractive to a broad range of tenants and buyers, including remote tech workers drawn to its lifestyle and amenities.

Though cap rates of 5.5–6.5% may not be the highest in Boston, Jamaica Plain's stability and potential for long-term appreciation make it an excellent choice for growth-minded investors.

4. Beacon Hill

Boston's historic Beacon Hill stands out as a prime area for real estate investment, offering a blend of charm, exclusivity, and market stability. Its picturesque cobblestone streets and timeless appeal come with premium price tags, but the neighborhood delivers strong rental demand and consistent performance.

As of mid-2025, the median listing price in Beacon Hill is an impressive $1.8 million, with an average of $1,230 per square foot [1]. According to Joe Wolvek from Gibson Sotheby's, the Q2 2025 median sale price was $967,500, with a similar price per square foot of $1,226, far surpassing Boston's overall median of $870,000 [1][20].

The broader market trends in 2025 reveal some cooling. Home prices in the area dipped by 3.3%, and the average time on the market increased from 25 days to 69 days. Additionally, sales volume dropped, with 33 homes sold in May 2025 compared to 47 homes during the same month in 2024 [19].

Strong Rental Market

Beacon Hill continues to shine as a rental hotspot. The average rent in May 2025 is $3,129, significantly higher than Boston's citywide average [21]. Rental rates for individual unit types highlight the premium tenants are willing to pay:

- Studios: Around $2,150

- One-bedrooms: Approximately $2,850

- Two-bedrooms: About $3,730

- Three-bedrooms: Roughly $4,700 [1]

Rental properties in Beacon Hill move quickly, with a median rental time of just 7 days, compared to 28 days citywide. The availability rate is a low 5.41%, and the vacancy rate is even tighter at 0.53% [21]. These figures underscore the neighborhood's appeal among tenants seeking convenience and prestige.

Walkability and Transit Access

Beacon Hill’s location adds to its investment allure. With a Walk Score of 99/100 and a Transit Score of 100/100, it earns the titles of "Walker's Paradise" and "Rider's Paradise" [19]. Residents enjoy easy access to downtown Boston, making it a top choice for professionals who value proximity to work and amenities.

Historic Charm and Stability

The neighborhood's historic preservation rules limit new construction, which helps maintain property values and rental rates. While projected rent growth for 2025 is a modest 1-2%, this stability appeals to investors looking for predictable, long-term returns [21].

Property managers often praise the quality of tenants in Beacon Hill, noting low turnover and minimal vacancy costs. The area’s prestige attracts renters willing to pay a premium for its unique blend of history, location, and lifestyle.

While investing in Beacon Hill requires substantial capital, its historic charm, prime location, and dependable rental market make it a compelling choice for those seeking high-end, stable returns. Next, we’ll explore the Seaport District to uncover more investment opportunities.

sbb-itb-f750c3f

5. Seaport District

Boston's Seaport District has transformed from an industrial waterfront into a thriving hub for innovation, luxury living, and commercial activity. Thanks to modern developments and significant infrastructure upgrades, it’s now one of the city’s most promising areas for investment.

As of May 2025, the median sale price in the Seaport District stands at $1.9 million, reflecting a 37.6% decrease compared to the previous year. The median price per square foot is $1,750, down 20.4% year-over-year. In May 2025, 16 homes were sold, compared to 13 in the same month last year, while the average time on the market rose from 42 to 72 days. This shift provides buyers with more negotiating power [22].

Infrastructure and Development Drivers

The district's growth has been fueled by major infrastructure projects, including the Third Harbor Tunnel, Central Artery improvements, MBTA enhancements, and upgrades at Logan International Airport. These initiatives have significantly improved accessibility, complemented by direct Silver Line service [23][2].

In addition to infrastructure, the neighborhood is seeing rapid urban development. Projects like Seaport Square - a large-scale mixed-use development - are reshaping the area into a walkable, vibrant community that caters to residents and businesses alike [24].

Life Sciences and Innovation Hub

The Seaport District has also emerged as a key player in Boston's life sciences and innovation sectors. The area now boasts around 6 million square feet of lab and life science space, supporting its role in Boston's expanding innovation economy. This growth is bolstered by steady population increases, with the city adding about 10,000 residents annually between 2010 and 2020 [23].

Rental Market Potential

High per-square-foot rental rates make the Seaport District particularly attractive to high-income tenants. With a citywide vacancy rate of roughly 2.8% [1] and rising interest rates discouraging home purchases, demand for rentals remains strong. Additionally, the district's focus on sustainable construction practices appeals to environmentally conscious residents and investors, further enhancing its long-term appeal [24].

The Seaport District offers a unique chance for investors to be part of one of Boston's most transformative urban developments. With its mix of innovation, luxury, and accessibility, the area is well-positioned to evolve into a premier destination for both residential and commercial opportunities.

Neighborhood Comparison: Pros and Cons

Boston's neighborhoods each bring their own mix of opportunities and challenges for investors. Here's a quick breakdown of the pros and cons of some of the city's most talked-about areas:

| Neighborhood | Median Price | Price Change (YoY) | Key Pros | Key Cons |

|---|---|---|---|---|

| South End | $1,300,000 | N/A | Historic charm, prime location, strong rental demand | High entry cost, limited inventory |

| Dorchester | $735,000 | +10.5% | Strong appreciation, diverse housing options, transit access | Varies by sub-area, potential gentrification |

| Jamaica Plain | $785,000 | N/A | Vibrant community, artsy vibe, good transit | Market fluctuations, parking issues |

| Beacon Hill | $1,800,000 | N/A | Prestigious location, historical appeal, stable values | Extremely high prices, strict regulations |

| Seaport District | $1,900,000 | N/A | Modern amenities, innovation hub, great infrastructure | Price swings, challenges of a newer market |

Price Point Analysis

Boston's neighborhoods fall into distinct price tiers, making it easier to match investment goals with budget. For example, Dorchester stands out with a notable 10.5% year-over-year price increase, while Jamaica Plain provides a more accessible entry point at around $785,000. These areas offer promising potential for appreciation as Boston's real estate market continues to evolve.

Investment Strategy Considerations

If you're focused on cash flow, neighborhoods like Dorchester and Jamaica Plain are worth a closer look. Lower entry costs combined with Boston's average rent of $3,334 (as of May 2025) [25] make these areas appealing for rental income. Strong rent-to-price ratios can help maximize returns.

For those eyeing long-term appreciation, premium neighborhoods like Beacon Hill and the South End might be more attractive - though higher entry prices and potential market volatility are important to weigh.

"We're seeing high levels of interest and demand", said Alfred Schofield, Managing Partner at the Guthrie Schofield Group. "But buyers today are more discerning. The era of emotional bidding and blind escalations has largely given way to a more grounded, analytical approach." [27]

Risk Assessment

Risk levels vary depending on the neighborhood. Established areas like Beacon Hill and the South End offer more predictable performance thanks to their prestige and limited supply. Dorchester, while presenting moderate risk, is backed by strong fundamentals. The Seaport District, as an emerging market, may see greater volatility.

Regulations are another factor to consider. Beacon Hill’s strict historical preservation rules can limit renovation opportunities, while newer areas like the Seaport may face zoning changes as they grow.

Short-Term Rental Potential

For those considering Airbnb or similar platforms, Boston’s short-term rental market offers a median annual revenue of $34,761, with occupancy rates averaging 48.3%. Premium locations tend to command higher daily rates [28].

Long-Term Growth Drivers

Infrastructure improvements are reshaping Boston’s neighborhoods. Dorchester is benefiting from transit upgrades and waterfront projects, while the Seaport District continues to attract modern businesses and innovation hubs.

Boston’s steady population growth - about 10,000 new residents annually between 2010 and 2020 [23] - combined with limited developable land supports long-term value growth across the city. However, the pace and scale of growth will vary depending on the neighborhood.

Conclusion

Boston's top investment neighborhoods each bring something unique to the table, catering to a variety of financial goals and strategies. South End is ideal for those seeking consistent, high-quality income. Dorchester stands out for its affordability and potential for strong appreciation. Jamaica Plain offers opportunities tied to its vibrant community growth, while Beacon Hill appeals to investors prioritizing prestige and long-term value preservation. Meanwhile, the Seaport District is a prime choice for those drawn to modern amenities and Boston's thriving innovation economy. Matching your investment approach with the character of these neighborhoods is a crucial step toward success.

Beyond these neighborhood insights, Boston's market fundamentals remain strong. With unemployment at a stable 3.8% and steady demand fueled by the city's expanding tech sector and focus on sustainable living, the city offers a solid foundation for long-term investments. For first-time investors, areas like Dorchester provide an entry point below the city median, paired with promising appreciation potential.

"The millennials who drove demand for highly amenitized, Class A buildings when they were in their 20s are now in their 30s and ready to move up to more space, direct outdoor access, and natural surroundings", explains Adelaide Grady, Partner and Senior Vice President of Leggat McCall Properties [30].

The Elle Group is here to guide investors through Boston's dynamic real estate landscape. By offering expert market analysis and crafting tailored strategies, we ensure your investments align with your goals. Our services include detailed deal analysis, annual asset reviews, and ongoing support to help you navigate Boston's ever-evolving market.

With median home values typically ranging between $800,000 and $900,000 [26], selecting the right neighborhood requires balancing your budget, timeline, and investment goals. By combining local expertise with strategic planning, The Elle Group helps clients minimize risks and maximize returns, making the most of Boston's diverse real estate opportunities [29].

FAQs

What should investors consider when deciding between Dorchester and Beacon Hill for real estate investment?

When weighing real estate investment options in neighborhoods like Dorchester and Beacon Hill, it's important to look at factors like growth potential, property types, and market demand.

Dorchester is seeing a wave of development, with investments in housing and infrastructure creating opportunities for more affordable options such as multi-family homes and condos. This makes it a compelling option for investors focused on properties with room for value growth over time. In contrast, Beacon Hill is known for its historic charm and luxury appeal, with median home prices topping $2 million. It caters to those interested in high-end properties and long-term value appreciation.

Market trends, including rising home prices, sales activity, and proximity to key amenities, should also play a role in your decision. Each neighborhood offers distinct advantages, so aligning your investment strategy - whether affordability or exclusivity is your priority - will help you make the right choice.

How are infrastructure upgrades in Boston's Seaport District influencing its real estate investment potential?

Boston's Seaport District: A Growing Hub for Investment

Boston's Seaport District is undergoing a remarkable transformation, thanks to substantial infrastructure upgrades and a staggering $22 billion in public investment. Projects like the inner harbor turning basin are reshaping the area, enhancing its waterfront charm, and drawing attention from major businesses, residents, and industries like tech and healthcare.

These developments are driving up property values and fueling demand, making the Seaport District a hotspot for real estate investors looking for long-term growth and promising returns. Beyond investment opportunities, these upgrades are elevating the area's appeal as a vibrant, livable, and thriving neighborhood, cementing its reputation as one of Boston's most dynamic destinations.

What are the advantages and risks of investing in Jamaica Plain compared to other top Boston neighborhoods in 2025?

Investing in Jamaica Plain: Pros and Cons

Jamaica Plain offers a lot to investors, making it a sought-after neighborhood in Boston. It combines strong growth potential with a vibrant community atmosphere, which attracts a steady demand for rental properties. This dual appeal positions it as a solid choice for those looking for long-term property appreciation or reliable rental income. On top of that, the mix of urban conveniences and lush green spaces draws in a diverse group of residents, adding to its overall charm for investors.

That said, Jamaica Plain does come with its share of challenges. Property prices are notably high, and intense market competition can make finding the right deal tricky. Additionally, fluctuations in the housing market and rising interest rates could affect your returns. While the neighborhood’s community-focused vibe sets it apart from other areas, taking the time to thoroughly analyze the market conditions is key to making the most of your investment.